SINGAPORE – More companies are set to freeze wages over the next year as business confidence weakens because of ongoing economic uncertainties, a Singapore Business Federation (SBF) survey released on Aug 28 found.

Business satisfaction with the current state of the economy has slipped to 33 per cent, from 35 per cent the previous year; more companies are now expecting conditions to worsen rather than improve over the next 12 months.

This growing pessimism is translating into more cautious wage policies. The share of businesses planning to freeze wages has risen to 41 per cent, from 35 per cent; those intending to bump up salaries has fallen to 59 per cent, from 64 per cent in 2024’s survey.

The wage freeze trend is being driven primarily by smaller companies, with 43 per cent of small and medium-sized enterprises (SMEs) planning to hold wages steady, against just 28 per cent of large companies.

Just over half of companies increased wages in the past year and plan to continue doing so over the next 12 months, with banking and insurance companies alongside manufacturers leading the way in salary hikes.

In contrast, businesses in the real estate activities, and construction and civil engineering sectors are intending to maintain a wage freeze.

Rising manpower costs remain the top workforce challenge for businesses, though the proportion citing this as a concern has eased to 65 per cent, from 75 per cent in 2024.

Upskilling and reskilling difficulties have emerged as the second-biggest challenge, with nearly half of businesses (47 per cent) now flagging this as a concern, a sharp increase from 25 per cent previously.

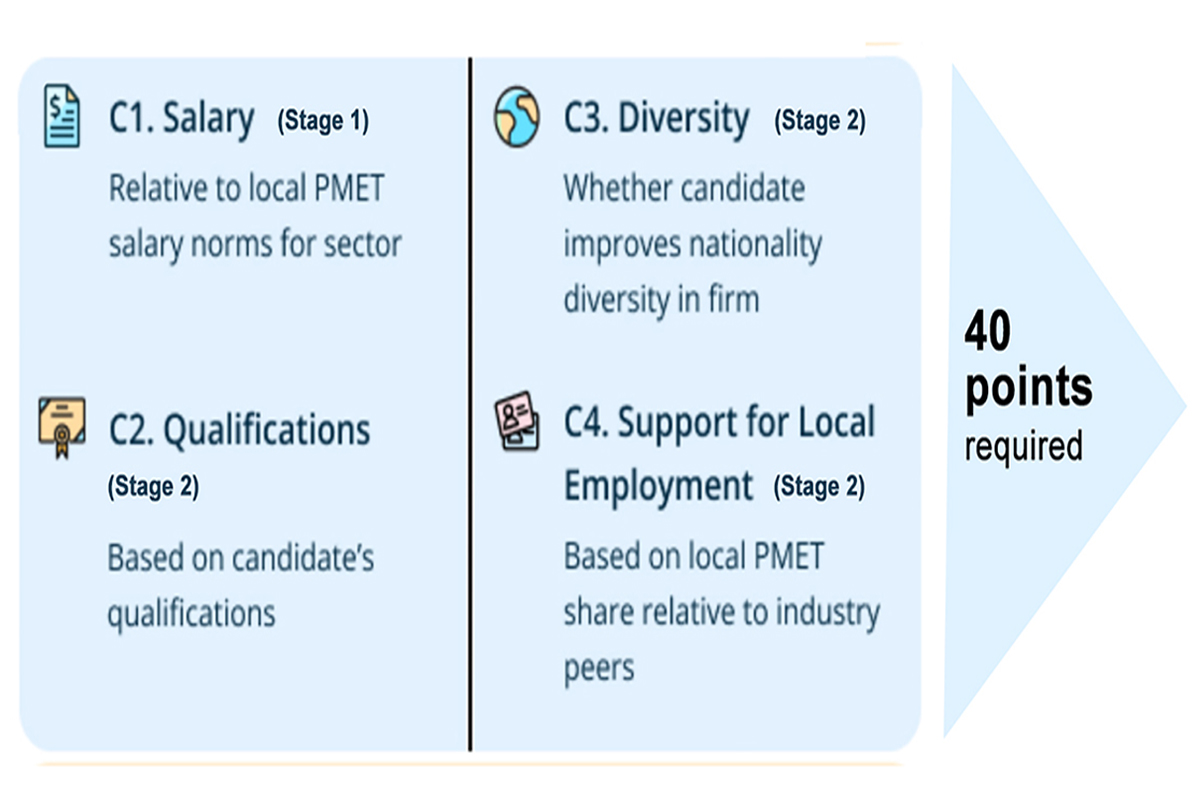

Meanwhile, worries about foreign manpower policies that drive up costs have moderated to 45 per cent from 53 per cent, but still rank among the top five workforce challenges.

Hiring outlook and retraining

Hiring intentions have weakened, with 36 per cent of businesses expecting to expand headcount over the next 12 months. This is down from 40 per cent in 2024.

However, this trend varies by company size. Large companies have become more optimistic about hiring, with 41 per cent planning to expand headcount, compared with 35 per cent before.

In contrast, SMEs have grown more cautious, with hiring intentions dropping to 36 per cent, compared with 2024’s 42 per cent.

At the sector level, hospitality, administrative support services and IT firms remain the most pessimistic about prospects, while health and social services and education businesses are more upbeat.

As for workforce development, the survey found that only 18 per cent of businesses have fully embraced skills-first hiring practices. Many cited uncertainty over whether candidates with adjacent skills can perform required tasks, and concerns about additional training needs as reasons for not adopting these practices.

Companies want more support to adopt such practices, with 44 per cent seeking financial grants and 33 per cent calling for skills-based recruitment portals to better match employers with job seekers.

Two-thirds of businesses trained or upskilled staff in the past 12 months, down from 71 per cent in 2024. Cost concerns topped the list of training barriers (48 per cent), alongside worries about having insufficient manpower to cover for staff undergoing training (48 per cent).

Other challenges include difficulty measuring returns on training investments (31 per cent), and fears that employees may leave before training benefits materialise (31 per cent).

The survey also found that three in 10 businesses implemented job-redesign initiatives, primarily targeting productivity and innovation improvements (63 per cent), followed by digitalisation (40 per cent), sustainability (34 per cent) and internationalisation (15 per cent).

Employee resistance to change, however, remains the biggest obstacle to these initiatives (42 per cent), along with the need to upskill staff to meet new or revised job scopes (29 per cent) and resource constraints (27 per cent).

Low-wage workers

While wage raises are not expected on the whole, 66 per cent of businesses still intend to increase lower-wage workers’ salaries in the next 12 months, up from 64 per cent in 2024. More large companies (69 per cent) plan to increase wages for lower-wage workers than SMEs (65 per cent).

Separately, 57 per cent of businesses have adopted the National Wages Council’s recommended wage increase for lower-wage workers, up from 51 per cent in 2024.

Among the companies that did not follow the recommendations, the most common reasons cited were that they are already paying lower-wage staff at market rates (42 per cent), poor company performance (36 per cent) and concerns about rising business costs (34 per cent).

That said, the adoption of the Progressive Wage Model (PWM) among businesses has declined to 32 per cent, from 39 per cent previously.

Companies that have implemented the model cite high adoption costs that hurt competitiveness, and difficulties in finding time for workers to attend training as the main challenges.

Beyond financial support, businesses are seeking more accessible training options, practical guidance on implementing PWM requirements and recognition as PWM employers.

Source: THE BUSINESS TIMES